“Loan Contracts and Legal Obligations: What You Need to Know” focuses on the essential elements of loan agreements and the responsibilities they impose on borrowers and lenders. Here are five critical questions and answers about loan contracts and their legal implications, along with a summary table highlighting key components of these agreements:

Q: What is a loan contract?

A: A loan contract is a legally binding agreement between a borrower and a lender that outlines the terms and conditions of a loan, including repayment obligations, interest rates, and any other pertinent details.

Q: Why is it important to thoroughly understand a loan contract before signing?

A: Understanding a loan contract ensures that the borrower is fully aware of their rights and responsibilities, which helps prevent misunderstandings and potential legal disputes.

Q: What are some common elements found in a loan contract?

A: Common elements include the loan amount, interest rate, repayment schedule, fees and penalties, collateral (if any), and clauses outlining default conditions and remedies.

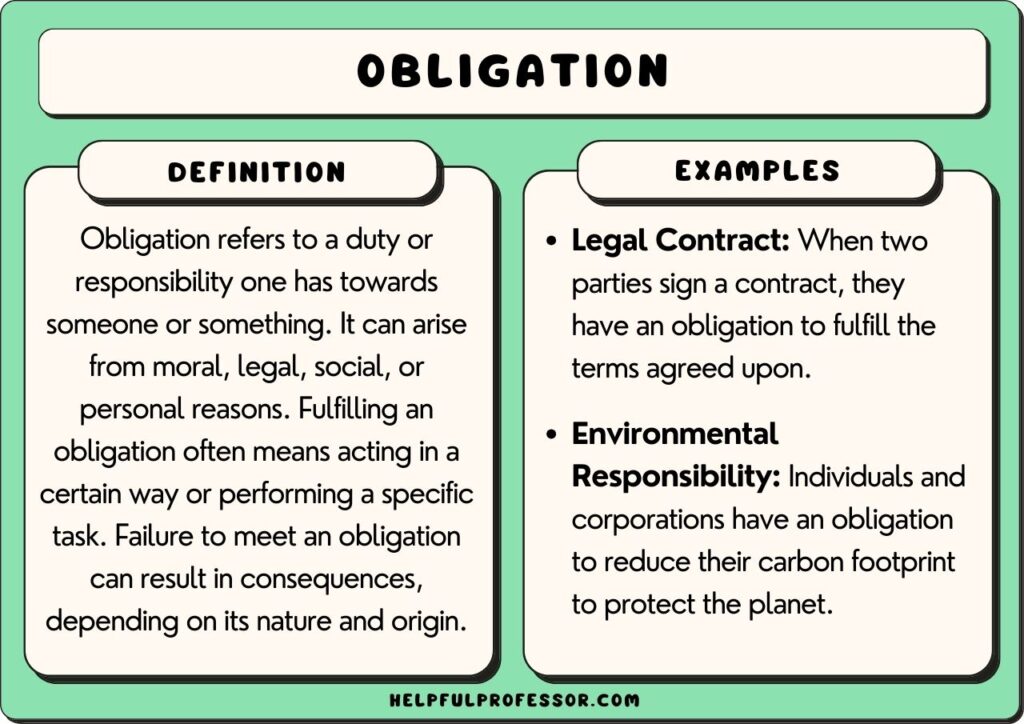

Q: What legal obligations do borrowers have under a loan contract?

A: Borrowers are legally obligated to repay the loan according to the agreed-upon terms, make timely payments, and adhere to any other stipulations in the contract.

Q: What recourse do lenders have if a borrower defaults on a loan contract?

A: If a borrower defaults, lenders can pursue legal action, repossess collateral, or report the default to credit bureaus, which can negatively impact the borrower’s credit score.

Table: Key Components of a Loan Contract

| Component | Description | Importance for Borrowers |

|---|---|---|

| Loan Amount | The total sum of money being borrowed | Defines the principal that needs to be repaid |

| Interest Rate | The percentage charged on the loan amount for borrowing | Determines the cost of the loan over time |

| Repayment Schedule | The timetable for making loan payments (e.g., monthly, quarterly) | Helps borrowers plan and budget for repayments |

| Fees and Penalties | Additional charges for late payments or early repayment | Alerts borrowers to potential extra costs |

| Collateral | Assets pledged by the borrower to secure the loan | Provides security for the lender and can affect loan approval |

| Default Conditions and Remedies | Conditions under which the borrower is considered in default and actions the lender can take | Clarifies the consequences of non-compliance with loan terms |

“Loan Contracts and Legal Obligations: What You Need to Know” emphasizes the importance of understanding the details of loan agreements to ensure informed borrowing decisions. By familiarizing themselves with the terms and legal obligations outlined in loan contracts, borrowers can better manage their financial commitments, avoid default, and maintain a positive relationship with lenders. This knowledge is crucial for protecting one’s financial health and ensuring compliance with legal requirements.